Table of Contents

- Social Security Benefits, Finances, and Policy Options: A Primer ...

- Is Social Security Going Broke? - The Center For Garden State Families

- Minimum Social Security Benefit For 2024 - Matty Shellie

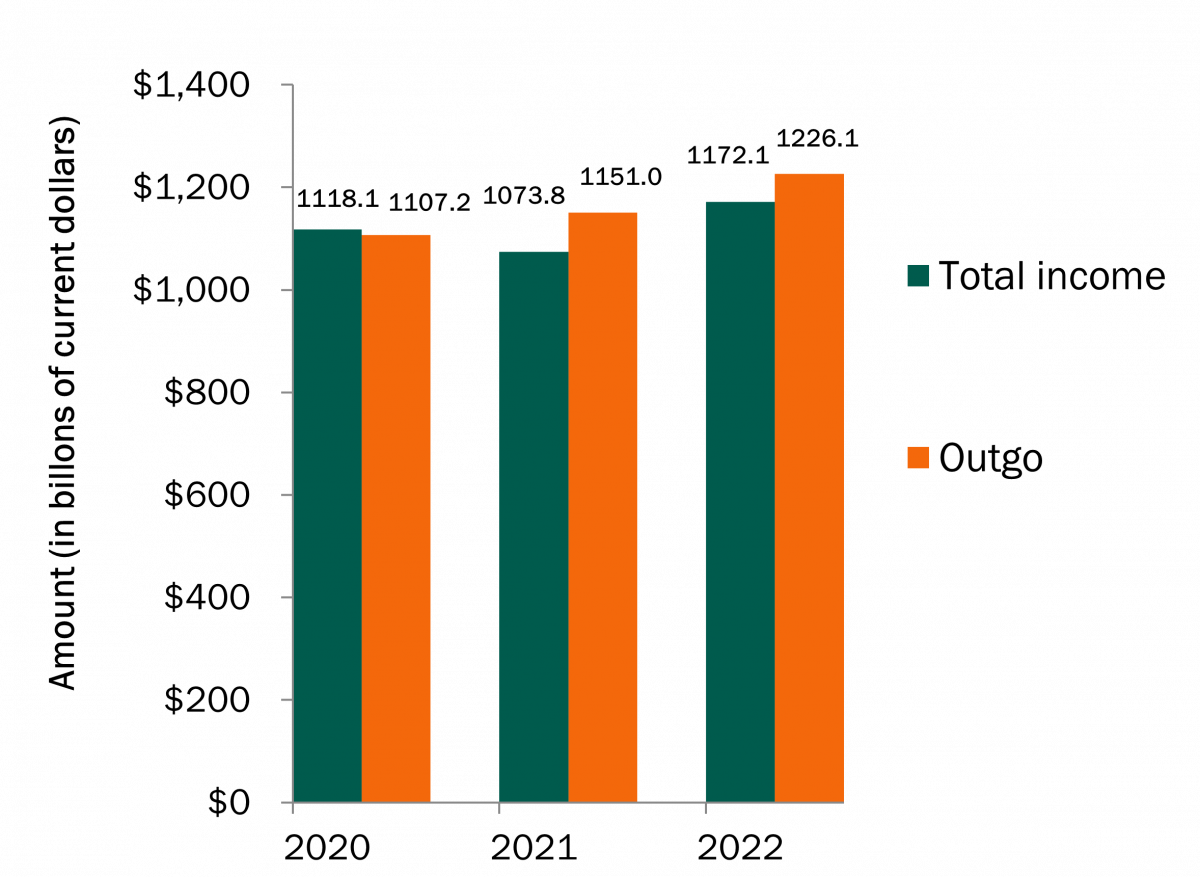

- Is Social Security Going Broke?

- Estimated 2025 IRMAA Brackets: Navigating The Income-Related Monthly ...

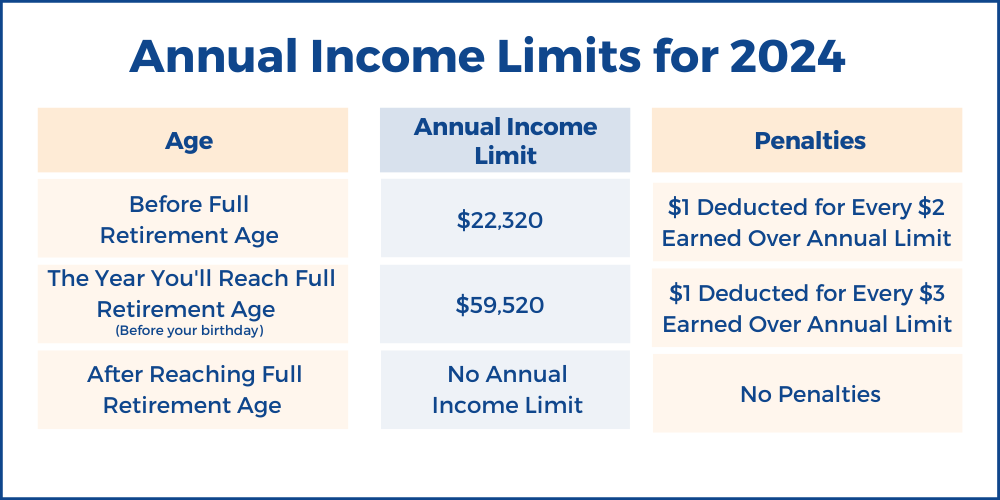

- Social Security Income Limit 2024 Chart - Sella Sophronia

- Ssa Income Limits 2024 - Seana Romona

- Medicare Premiums Based On Income 2025 Irmaa - Hana Clara

- Social Security Increases By Year 2024 - Carena Muffin

- Social Security - BIRDSEYE FINANCIAL SERVICES (360) 722-7889

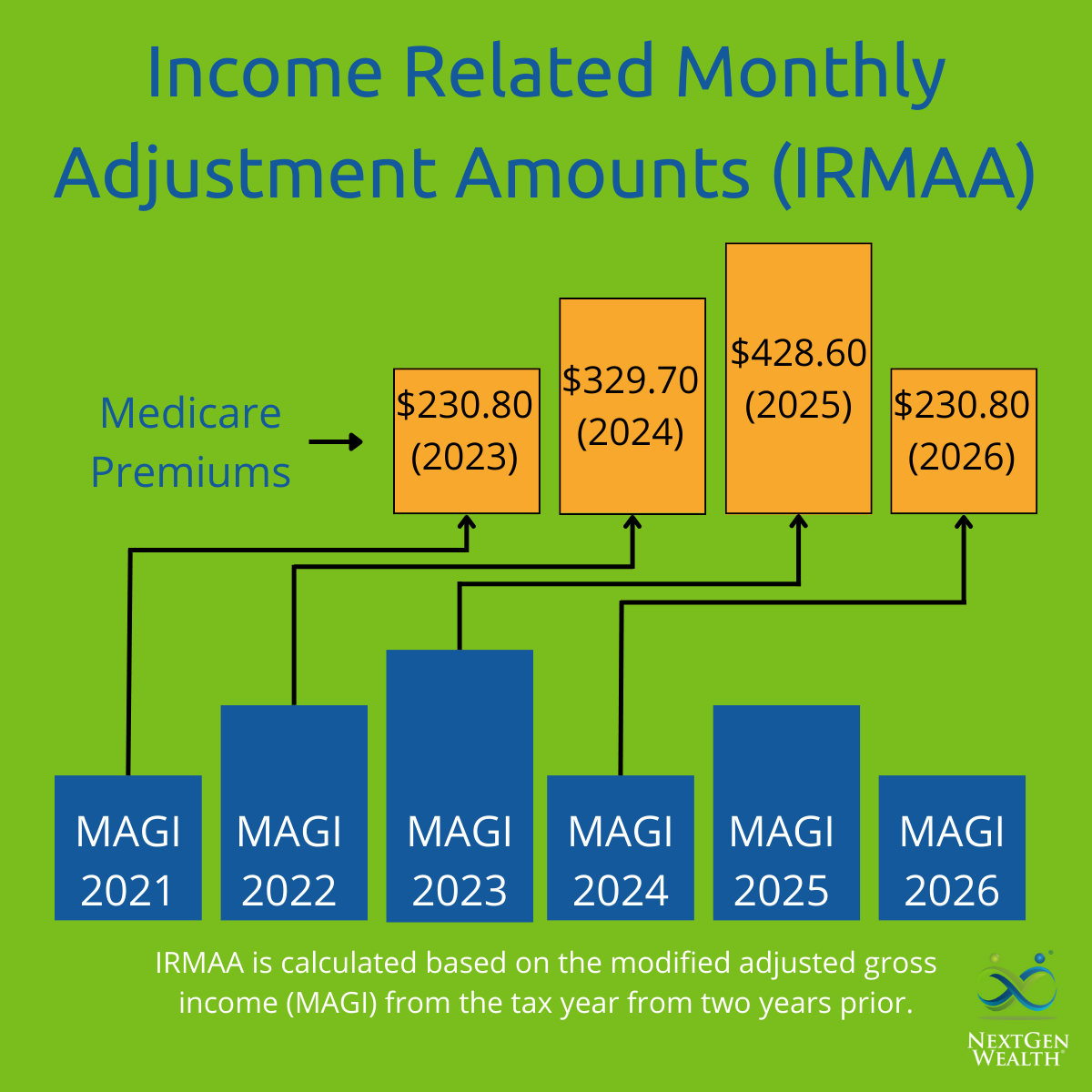

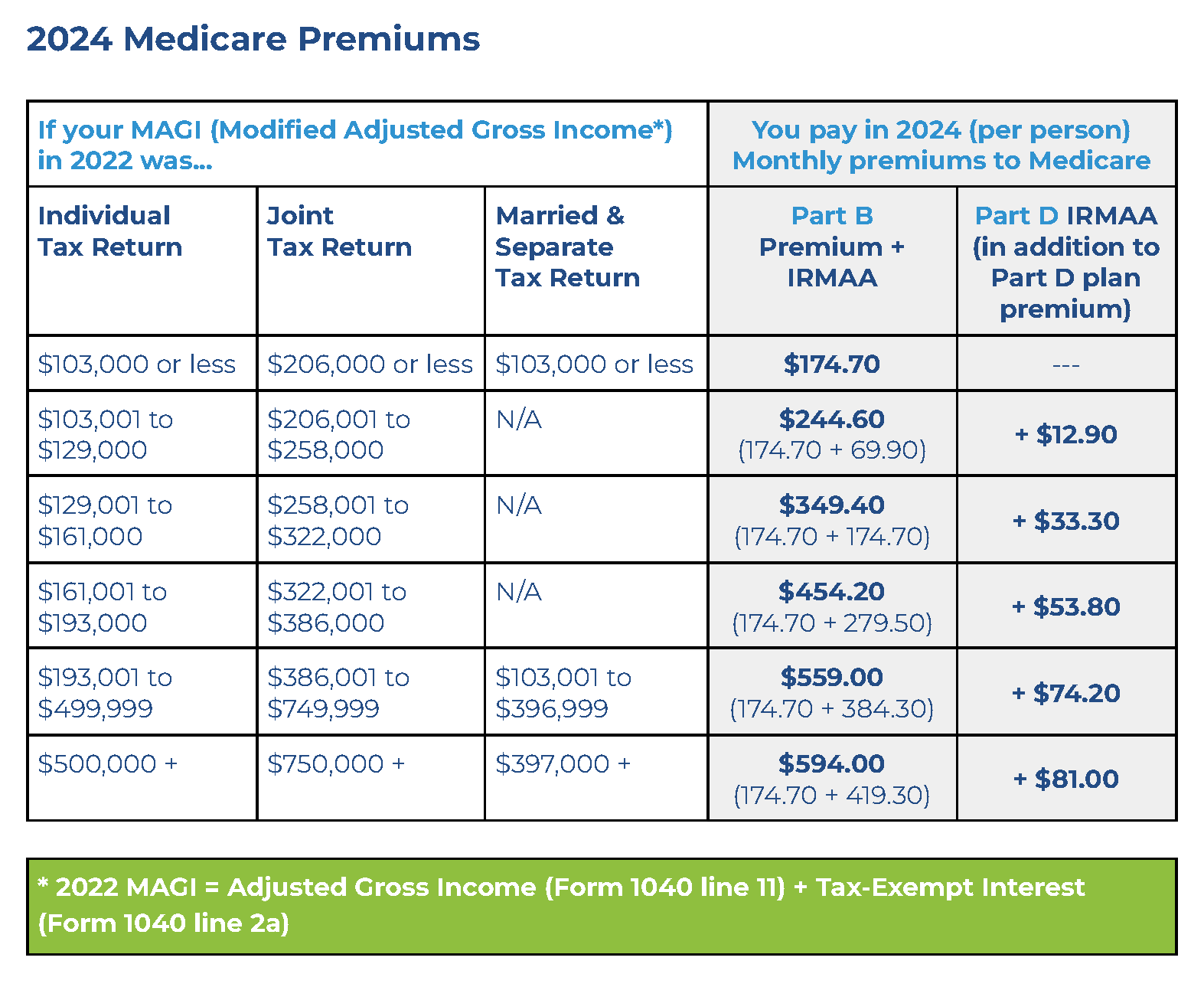

What is the Medicare Income-Related Monthly Adjustment Amount (IRMAA)?

.png?format=1500w)

How is the IRMAA Calculated?

What are the Income Thresholds for IRMAA?

For 2022, the income thresholds for IRMAA are as follows: Single filers: + $88,000 or less: No IRMAA + $88,001 to $111,000: $59.40 per month (Part B) and $12.30 per month (Part D) + $111,001 to $138,000: $72.10 per month (Part B) and $31.80 per month (Part D) + $138,001 to $165,000: $84.80 per month (Part B) and $51.20 per month (Part D) + $165,001 to $500,000: $97.40 per month (Part B) and $70.70 per month (Part D) + $500,001 or more: $111.80 per month (Part B) and $77.10 per month (Part D) Joint filers: + $176,000 or less: No IRMAA + $176,001 to $222,000: $59.40 per month (Part B) and $12.30 per month (Part D) + $222,001 to $276,000: $72.10 per month (Part B) and $31.80 per month (Part D) + $276,001 to $330,000: $84.80 per month (Part B) and $51.20 per month (Part D) + $330,001 to $750,000: $97.40 per month (Part B) and $70.70 per month (Part D) + $750,001 or more: $111.80 per month (Part B) and $77.10 per month (Part D)